The Global Evolution of Nintendo: From Toy Company to Industry Giant

In the year 1980, Nintendo was not the household name it is today; rather, it was a modest Japanese toy company taking its first cautious steps into the burgeoning world of video games. That pivotal year saw the establishment of Nintendo of America, a strategic move aimed at exporting arcade machines to the United States. Initially, this venture was fraught with challenges, as the company had ordered 3,000 arcade machines featuring a lackluster game that failed to attract players. In a bid to salvage their investment, Nintendo reached out to their headquarters in Japan, requesting a new game that could run on the unused hardware. This request led to the creation of what would become a legendary title: Donkey Kong. The game not only became a sensation, but it also introduced players to Mario, marking the beginning of Nintendo's incredible journey on the global stage.

Fast forward four decades, and Nintendo is on the brink of launching its highly anticipated console, the Switch 2. This new device represents more than just a product for the Japanese market; it is a truly global gaming console that is being eagerly awaited by gamers around the world. Interestingly, the Switch 2 will not even be released in Japan first, highlighting its international significance. In this modern age, characterized by trade wars and shifting economic landscapes, the console's identity has evolved beyond its Japanese roots. The intricate process of creating this device involves collaborations with a myriad of companies and countries, effectively illustrating the complexities of global trade in the technology sector.

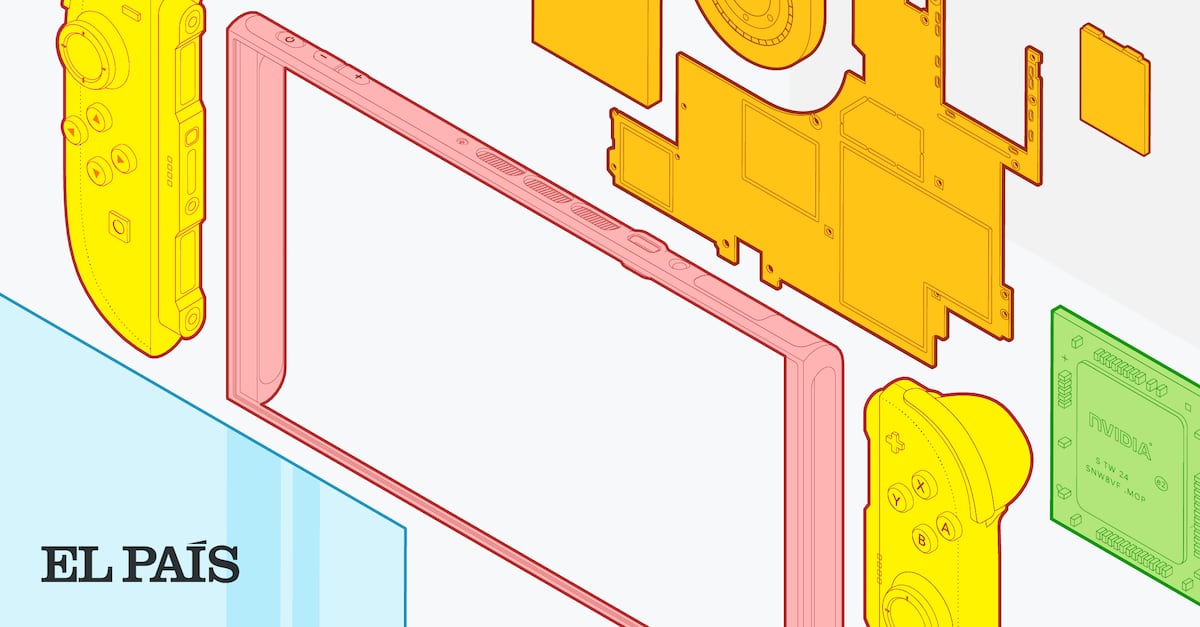

To understand the expansive reach of the Switch 2, one can begin by examining the origins of its components. Dismantling the console reveals a network of suppliers spread across three continents. This international collaboration is akin to a fractal, where each part of the console is interconnected with various chains of production. At the heart of the Switch 2 lies its processor, which will be sourced from Nvidia, a leading technology company based in the United States. Nvidia has soared in market value, becoming the third most valuable company globally, thanks in large part to its innovations in artificial intelligence. Speculations suggest that the processor will be a Tegra model, combining audio and video capabilities with the CPU and GPU, making it the central “brain” of the console.

Designing such a sophisticated chip is a feat achieved by only a select few companies worldwide. Despite being based on 2021 technology featuring an 8-nanometer process, this chip is considered among the most advanced, with only a handful of companies like Apple, AMD, Qualcomm from the U.S., Samsung from South Korea, and HiSilicon from China being able to create such technology. The design process itself is highly dependent on specialized tools known as Electronic Design Automation (EDA) tools, which are exclusively provided by companies like Cadence in the U.S. and Siemens in Germany. Furthermore, these design efforts rely on architectures licensed from ARM, a UK-based firm.

After the design phase, the next crucial step is chip manufacturing. Samsung, located in South Korea, will take on this responsibility. The landscape for advanced semiconductor manufacturing is starkly limited, with only two companies capable of producing chips at 5 nanometers or smaller: Samsung and Taiwan Semiconductor Manufacturing Company (TSMC). Though Chinese foundries like SMIC are progressing, they have yet to reach this technological pinnacle. This duopoly highlights the concentrated nature of the tech industry. Compounding these challenges is the ongoing tech war between the U.S. and China, which has resulted in restrictions on companies like Nvidia from selling their most advanced technologies to Chinese firms. TSMC is also expanding its operations in the U.S., establishing factories in Arizona as part of this geopolitical landscape.

Yet, the journey of the Switch chip does not end with manufacturing. The silicon wafers, which contain hundreds of chips, will be shipped from Samsung’s foundries to be packaged and tested, a process that might be carried out by Amkor, an American company with facilities in the Philippines. Here, each chip undergoes cutting, pin attachment for mounting, and sealing within protective casings. Following this, the semiconductors will travel to Vietnam, where Foxconn will assemble them with various other components, including Taiwanese screens, Chinese batteries, and South Korean memory. Remarkably, each chip will have journeyed over 15,000 miles before a gamer in Madrid hits “Start” on their console.

This intricate, 15,000-mile supply chain is precisely what former President Donald Trump has threatened to disrupt. Coincidentally, on the very day the Switch 2 was announced, April 2, Trump was declaring a trade war against U.S. partners during a celebration of what he called “Liberation Day.” His administration has implemented a series of tariffs, often characterized by inconsistency: they have been imposed, lifted, reduced, and reinstated in tumultuous waves of policy decision-making.

Nintendo’s experience sheds light on the ramifications of these trade tensions. The company has opted to raise prices on accessories while keeping the console’s price stable for the time being. This decision places them in a fragile position, as early sales figures are crucial for establishing a strong market presence. According to Nintendo President Shuntaro Furukawa, the company’s priority is to swiftly expand the install base for the new hardware. However, he cautioned that any changes in tariff policies could lead to necessary price adjustments in the future.

Trump’s tariffs appear to be aimed at achieving a goal that may be fundamentally unrealistic: the complete return of manufacturing to the United States. However, this aspiration faces a formidable challenge. A report from The Wall Street Journal highlighted that assembling an iPhone in China incurs a cost of $30, whereas doing so in the United States would skyrocket to $300. Moreover, attempting to manufacture every single component domestically could cost “a bajillion dollars, and maybe a magic wand,” according to industry analyst Wayne Lam.

The Switch exemplifies the complexities involved in global manufacturing. Companies like TSMC and Samsung, once drawn to lower labor costs, now dominate the forefront of advanced technology. This expertise has been cultivated over decades, making it unlikely for the U.S. to replicate such specialized knowledge anytime soon. The same holds true for ASML, the only company capable of producing the extreme ultraviolet lithography machines essential for modern chip production.

This type of specialization leads to remarkable efficiency, which is evident in the substantial increase in global trade, rising twelvefold since 1960. Contrary to the belief that trade is a zero-sum game, where one nation’s gain is another’s loss, extensive research has demonstrated that countries engaging in trade tend to be wealthier, more productive, and innovative. The intricate components of the Switch collectively narrate a compelling story: the world has become increasingly specialized and interconnected. Dismantling this complex network would be a formidable and costly task.

Beyond the production aspects, Nintendo’s global reach extends to its user base as well. The company has successfully captured the hearts of players across multiple generations. From Generation X, who grew up with the Nintendo Entertainment System (NES), to millennials with the Game Boy, Generation Z enjoying the Wii, and now Generation Alpha who is discovering Mario’s adventures with the same excitement as their parents did.

The diverse demographic of Nintendo gamers is unparalleled in the industry. Analyst Andrew Szymanski noted that Nintendo’s appeal is not limited to hardcore gamers but reaches a wider audience than any competitor. This is substantiated by data from an Ipsos study conducted in the U.K., which revealed an equal number of men and women playing on the Switch. Contrary to common stereotypes, the console is not solely popular among children; Nintendo’s own data indicates that young adults in their twenties make up the largest demographic of players, outnumbering children and teenagers two to one, while those in their thirties also surpass those under 18.

Geographically, Nintendo’s success is widespread. In 2024, sales data indicated that the Americas accounted for a substantial 44% of Switch sales, while Europe and Japan contributed 25% and 24%, respectively. The narrative of Nintendo has evolved from being a Japanese exporter to becoming a genuinely global entity.

Another indicator of Nintendo’s expansive influence is the diverse range of game developers contributing titles for its consoles. Studios from around the world are creating innovative games for this platform. Among the 50 highest-rated Switch games on Metacritic, a rich tapestry of global talent emerges, showcasing 22 Japanese titles, including both highly acclaimed Zelda games within the top five. Yet, these Japanese gems share the spotlight with popular U.S. titles such as Portal and Metroid Prime, alongside international successes like Divinity from Belgium, Ori and the Will of the Wisps from Austria, and Celeste from Canada.

The variety of developers is impressive, encompassing not only industry giants like Nintendo but also independent studios that have made their mark. Standouts like Hades from Supergiant Games, Undertale, conceived solely by Toby Fox, and Hollow Knight from Team Cherry, a duo consisting of just two individuals, exemplify this diversity. Spain also makes its mark with Neva, developed by the Barcelona-based Nomada Studio, which has gained recognition on the global stage for its unique artistic style. The Switch serves as a platform where even solo developers can vie with multimillion-dollar franchises, embodying the hopeful spirit of globalization where talent can emerge from anywhere.

Nintendo’s global influence has been a constant over the past 30 years and continues to accelerate. The Game Boy achieved remarkable success, selling 118 million units over a span of 16 years (1989–2005). The Nintendo DS then raised the bar further, moving 154 million units in just eight years (2005–2013). Despite its higher price point and ambitious features, the original Switch has already equaled and is poised to surpass this milestone, with 152 million consoles sold within seven years (2017–2024).

Analysts predict that Nintendo will sell an additional 15 million consoles before the end of the year. One of the upcoming titles that will surely attract attention is Donkey Kong Bananza, featuring the same beloved character that played a crucial role in rescuing Nintendo of America 45 years ago. Today, Donkey Kong has evolved from a simple 16-pixel sprite into a fully realized 3D gorilla recognized worldwide, brought to life with cutting-edge technology sourced from multiple countries. Nintendo, therefore, stands as a testament to the interconnected nature of our global economy—it remains Japanese, American, Taiwanese, and ultimately global.

Stay informed about the latest developments in the world of gaming and technology by signing up for our weekly newsletter to receive English-language news coverage from EL PAÍS USA Edition.