Global Markets React to Ceasefire between Israel and Iran

SYDNEY: In an unexpected turn of events, oil prices plunged by 4 percent, while global stock markets experienced a notable surge and the U.S. dollar weakened on Tuesday. This dramatic shift came on the heels of an announcement from U.S. President Donald Trump, who stated that a ceasefire between Israel and Iran had been established. This news follows a tense weekend during which the U.S. conducted airstrikes targeting Iran's nuclear sites, raising concerns about escalating conflict in the region.

Oil prices had already experienced a significant decline, with Brent futures dropping 7 percent on Monday. The market reacted positively to indications from Iran that they had conducted a measured retaliation against a U.S. military base, suggesting a desire to de-escalate tensions for the time being. As a result, the global benchmark for oil prices fell to $67.68 per barrel, marking its lowest level since June 11. In the U.S., crude futures also decreased, down 3.6 percent to settle at $66.02 per barrel.

Prashant Newnaha, a senior Asia-Pacific rates strategist at TD Securities, commented on the market's shifting focus, stating, “With markets now viewing the escalation risk as over, market attention is likely to shift towards the looming tariff deadline in two weeks' time.” He noted that the rapid resolution of the Middle East conflict could lead to increased optimism regarding upcoming tariff negotiations and trade deals.

In the wake of the reduced geopolitical tensions, equity markets were in a celebratory mood. Risk assets rallied significantly, with S&P 500 futures climbing 1 percent and Nasdaq futures rising by 1.3 percent. In Europe, the Stoxx 600 index gained 1.3 percent during early trading hours. Travel-related stocks, such as airlines, surged by 4 percent, whereas oil and gas companies experienced a drop of 3 percent.

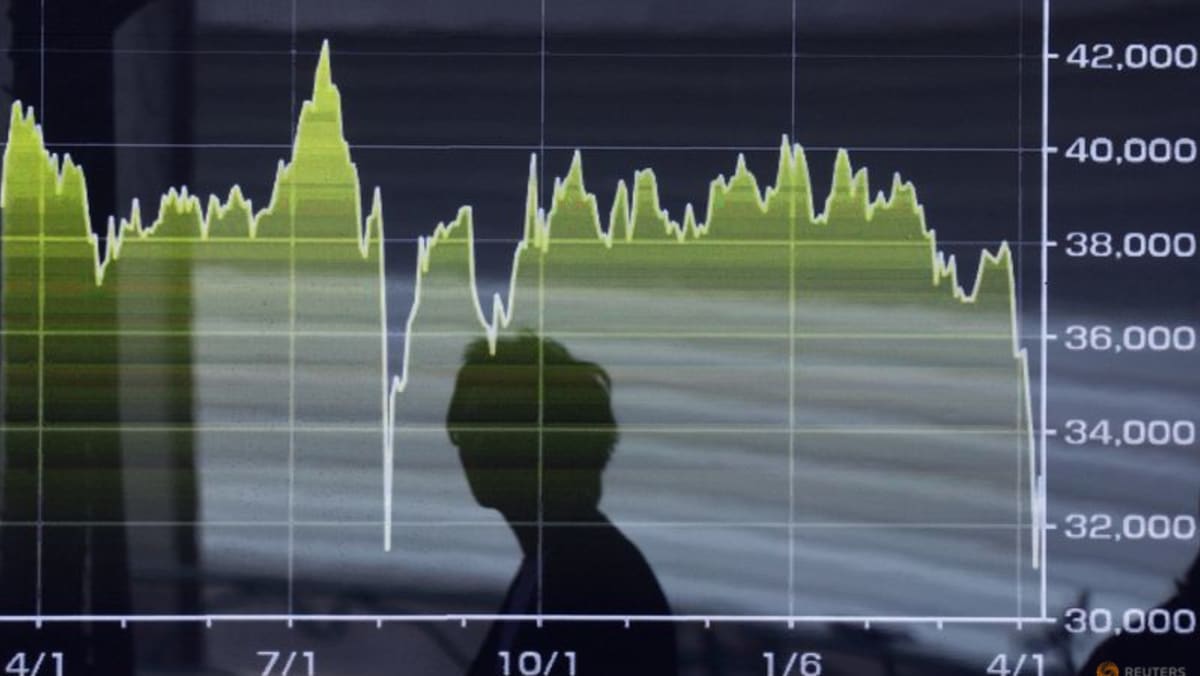

In Asia, the MSCI's broadest index of shares outside Japan recorded a 2.2 percent increase, while Japan's Nikkei index rose by 1.1 percent, reflecting the positive sentiment in financial markets.

On the trade front, sources informed Reuters that Japan's chief tariff negotiator, Ryosei Akazawa, was planning to make his seventh visit to the United States as early as June 26. This visit aims to discuss the resolution of tariffs that have been adversely affecting Japan's economy.

Meanwhile, government bonds largely remained unaffected by the recent news. The ongoing conflict and its economic implications have posed challenges for bond traders, who are balancing safe-haven investments with the potential impact of rising oil prices on inflation.

Rate Cuts on the Horizon?

Federal Reserve Vice Chair for Supervision Michelle Bowman indicated that the time for lowering interest rates may be approaching, particularly as risks to the job market appear to be increasing. This statement aligns with remarks made by Fed Governor Christopher Waller on Friday, who expressed openness to a rate cut during the Federal Reserve's upcoming meeting scheduled for July 29-30.

Fed Chair Jerome Powell is set to address Congress later on Tuesday, where he will likely provide further insights on the matter. Currently, markets are pricing in only about a 22 percent chance that the Fed will cut rates at the next meeting, though a reduction in September is almost fully anticipated.

The yield on ten-year Treasury bonds remained steady at 4.33 percent, having seen a modest decrease of 5 basis points overnight. In Germany, the ten-year yield held steady at 3.52 percent.

As news of the ceasefire spread, the dollar extended its overnight decline, falling by 0.7 percent to 145.43 yen after reaching a six-week peak of 148 yen just the day before. The euro also appreciated, gaining 0.2 percent to $1.1602, following a 0.5 percent rise overnight.

The yen and euro experienced gains due to the decline in oil prices, as both the European Union and Japan heavily depend on oil and liquefied natural gas imports, in contrast to the United States, which is a net exporter of these resources. The shift in market sentiment also led gold prices to decrease by 1 percent, settling at $3,333 an ounce.