Meta's Billion-Dollar Bet: Are We Ready for Superintelligence?

Imagine a world where artificial intelligence doesn’t just assist us but becomes a personal superintelligence tailored to every individual. This is no longer a mere fantasy; it's the bold vision that Meta's CEO Mark Zuckerberg is pursuing as he reshapes the future of technology.

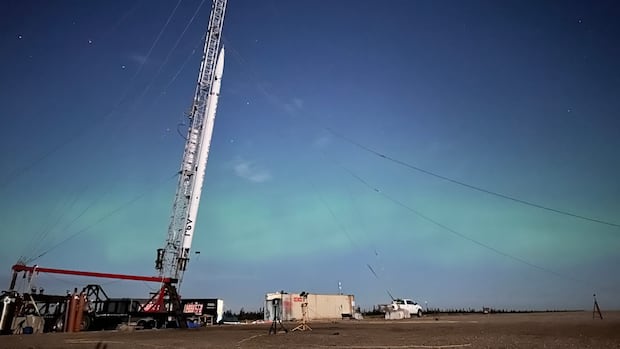

For over a month, Meta has been on a spending spree, snatching top talent from competitors, acquiring AI startups, and even announcing plans for data centers the size of Manhattan—all in a quest to enhance its artificial intelligence capabilities. In a memo released just ahead of the company’s quarterly earnings report, Zuckerberg shared his ambitious goal: to develop ‘superintelligence’ that improves not just productivity but personal empowerment.

“Over the last few months, we have begun to see glimpses of our AI systems improving themselves,” Zuckerberg excitedly noted. While he admitted the improvements are currently slow, he believes they are undeniable. However, this leap into a new realm of intelligence brings with it ‘novel safety concerns’ that need careful consideration.

What sets Meta apart from other AI firms is its unique focus on making superintelligence accessible to everyone. While many competitors are primarily looking to automate work and boost productivity, Zuckerberg envisions a future where AI enhances personal lives. “The rest of this decade seems likely to be the decisive period for determining the path this technology will take,” he added, raising the stakes for what could either empower individuals or disrupt society as we know it.

Investors are keen to know: does this AI ambition translate to cash flow? As the parent company of WhatsApp, Instagram, and Facebook prepares to report its second-quarter earnings, analysts are scrutinizing how Meta's lavish spending integrates with its financial performance. The Wall Street consensus anticipates earnings per share of $5.92, with a hefty revenue estimate of $44.8 billion. Yet, with investments in AI infrastructure soaring, the company must prove that its spending is not just a gamble but a pathway to profitability.

Financial analyst David Meier commented, “Meta can’t invest enough capital into its artificial intelligence infrastructure.” Zuckerberg has projected that by 2025, total expenses will reach between $113 billion and $118 billion, with capital expenditures between $64 billion and $72 billion—up from earlier estimates. This financial commitment raises the question: can Meta turn its AI dreams into reality without breaking the bank?

Furthermore, Meta is actively building its superintelligence labs by attracting top talent from rival companies. By investing $14.3 billion in Scale AI, Meta secured a 49% stake and brought in Scale’s CEO, Alexandr Wang, as its chief AI officer. The tech giant is reportedly luring engineers from Apple, GitHub, and other startups with eye-popping compensation packages, some exceeding $200 million.

“To win the superintelligence race requires the best of the best talent, and Meta has been on a roll,” stated Mike Proulx, a research director at Forrester. With money being no object, Meta is leveraging its financial muscle to draw in industry luminaries while spending billions on data centers to support its ambitious AI initiatives.

As Meta gears up for its earnings report, analysts are also keeping a close eye on advertising revenue, the company's primary income source. After years of avoiding monetization on WhatsApp, Meta announced plans to sell ads on the platform in June. This shift could be pivotal, and observers are eager to hear about the company's progress in this new venture.