Meta's AI Race: Can They Catch Up Before It's Too Late?

What happens when a tech giant known for its innovation struggles to keep pace with its rivals? Well, that’s the reality Meta is currently grappling with! Despite pouring billions into artificial intelligence (AI) and boasting a star-studded team, CEO Mark Zuckerberg’s ambitions to create artificial general intelligence (AGI) are teetering on the brink.

Meta has recently consolidated its AI efforts under a new umbrella named the Meta Superintelligence Labs (MSL). This latest restructuring marks the fourth major shake-up in just six months, aimed at tightening the connections between research, product development, and infrastructure. However, the specifics behind the internal reorganization remain largely under wraps.

This drastic restructuring reflects the considerable internal turmoil as Meta strives to regain its footing in an industry where competitors like OpenAI, Microsoft, and Google DeepMind are rapidly redefining the landscape. Once a leader in AI research, Meta has faced significant challenges in translating its innovative breakthroughs into consumer-ready products.

Take a journey back to 2013 when Meta launched the Facebook AI Research (FAIR) initiative, spearheaded by deep learning expert Yann LeCun. FAIR has since produced groundbreaking work, including the widely-used PyTorch framework, which has become essential for machine learning globally. In the late 2010s, FAIR expanded the frontiers of AI in areas such as unsupervised learning, robotics, and computer vision, leading to tools like DeepFace that showcased the potential of AI, albeit with privacy concerns looming overhead.

Despite this impressive track record, Meta has had difficulty turning its innovations into products that resonate with consumers. The Messenger assistant, M, was abandoned in 2018 due to its heavy reliance on human “trainers,” and other projects have fizzled out almost as quickly as they began, such as the Galactica scientific model which was withdrawn after mere days due to inaccuracies.

Meta’s most notable entry into the modern AI arena has been the LLaMA family of large language models. Launched in 2023, LLaMA was distinguishable by its open-source approach, allowing developers to access its model weights freely. This strategy gained Meta favor among developers and academics and encouraged adoption across startups seeking to build applications without the hefty price tag of proprietary models. However, this open approach also limited Meta’s ability to monetize its research effectively. Competitors could leverage Meta’s innovation without necessarily contributing value back to Meta’s ecosystem.

The subsequent release of LLaMA 4 in 2025 saw a lukewarm reception from insiders, emphasizing the growing pressures Meta faces to keep up with its more nimble counterparts. Reports of staff turnover and disagreements over strategic direction have only added fuel to the fire.

So what’s next for Meta? The advent of the Superintelligence Labs consolidates its AI teams into four primary strands: the TBD Lab, a Products group, an Infrastructure unit, and the existing FAIR research wing. Following a period of significant leadership transformation, Yann LeCun remains at the forefront, while Rob Fergus, co-founder of FAIR, has been appointed to lead the research initiative. Additionally, Shengjia Zhao has assumed the role of chief scientist at Superintelligence Labs, supported by Alexandr Wang as chief AI officer. Together, they inherit a company fraught with challenges in both strategy and execution.

This restructured leadership is now tasked with focusing Meta’s effort, striving to reconcile cutting-edge research with practical applications. Yet lingering doubts remain about whether mere structural changes can resolve the deeper cultural and operational issues within the company.

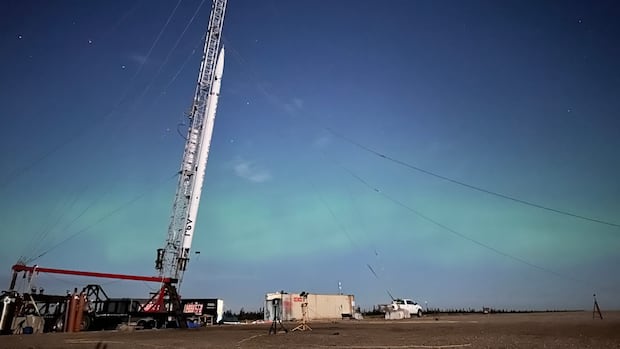

On the infrastructure side, Meta has made its intentions clear, pledging an investment between $66 billion and $72 billion in AI-ready data centers by 2025. This includes a massive $29 billion initiative in Louisiana that aims to enhance GPU capacity and infrastructure to support advanced model training. Meta is also promoting energy-efficient technologies to allay regulatory concerns and bolster community relationships. However, they face challenges that all hyperscalers encounter, such as managing electricity constraints and public scrutiny over AI's environmental impact.

Meta’s ambition to embed AI across its consumer platforms has resulted in the integration of the Meta AI assistant into Facebook, Instagram, WhatsApp, and even Ray-Ban smart glasses released in 2024. While this keeps AI in the spotlight for billions, early feedback suggests that Meta's offerings lack the refinement and uniqueness that competitors provide. The assistant's contributions to social media interactions appear limited, often feeling more like an add-on rather than a genuine innovation.

Moreover, Meta’s history marred by ethical missteps in AI continues to cast a long shadow. Investigations into inappropriate behaviors exhibited by its chatbots have raised safety and governance concerns. In light of this, the company has vowed not to release its most advanced “self-improving” models publicly, a decision that aligns with industry caution but contradicts its previous open-source philosophy.

Competing in this cutthroat AI landscape, Meta is not just fighting its internal demons. It’s up against formidable players, each with their unique advantages: OpenAI, with its seamless integration into the Azure cloud and productivity tools; Google DeepMind, leveraging its extensive consumer base and data resources; and Anthropic, which is carving out a niche with a focus on responsible AI practices. Meta's open-source strategy is bold but risky, as it may hinder its commercial viability while competitors continue to capitalize on enterprise contracts and cloud services.

In summary, Meta stands at a strategic crossroads. Despite being a powerhouse in AI research, it has struggled to translate its intellectual capital into market leadership. The establishment of Meta Superintelligence Labs has the potential for a sharper focus, yet reorganizations alone can’t substitute for a coherent go-to-market strategy. Amid talent losses, reputational challenges, and competitors racing forward, Meta risks becoming the “research lab of the industry”—influential but overshadowed. With billions invested and an ongoing reorganization, Meta is in pursuit of an AI future that feels ever-elusive. It possesses world-class researchers, a vast user base, and the infrastructure to compete, yet its continuous struggle to transform research into viable, differentiated products leaves it in a perpetual chase behind its rivals.