US Renewable Energy Investment Plummets as China Dominates Offshore Wind Market

What if I told you that while the US is trying to break away from China's grip on supply chains, China is simultaneously solidifying its position as the uncontested leader in offshore wind energy? As the Biden administration focuses on boosting domestic oil and gas production, the offshore wind industry in the US is getting hit by a tidal wave of challenges—from halted projects to increasing costs.

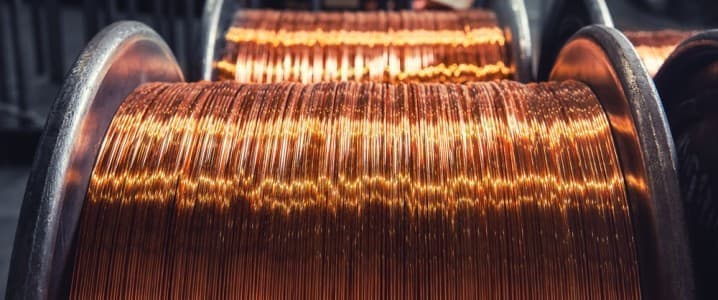

Research from Rystad Energy reveals that despite these tough conditions, global offshore wind capacity is set to soar to 16 gigawatts (GW) by the end of 2025, largely driven by projects in China, which will account for a whopping two-thirds of this growth. By 2030, it's projected that China will dominate 45% of the world’s offshore wind capacity, making it increasingly difficult for the US to keep pace.

The reality is stark: while the US is aiming for an energy policy shift, the resulting slowdown is not just stalling US offshore wind projects, it’s also prompting European developers to reconsider their investments in America. With the US decoupling from China, it appears that this separation is paradoxically giving China a leg up in the renewable energy race.

Alexander Fløtre, Senior Vice President and Head of Offshore Wind Research at Rystad Energy, pointed out that the halt in US offshore wind progress has already had visible effects. US renewable energy investments have dropped by a staggering 36% year-on-year as companies redirect their funds to more promising markets in Europe. Notably, projects like Orsted’s Rhode Island offshore wind development have faced stop-work orders, resulting in significant delays and uncertainties.

Meanwhile, Chinese state-owned enterprise CNOOC is moving forward with its offshore wind expansion plans, with a major 1.5 GW project set to launch before 2030. As European companies re-evaluate their US exposure, their reliance on China will only increase, painting a concerning picture for US competitiveness.

Creating a viable renewable energy supply chain to rival China seems increasingly unlikely. Many Western manufacturers are returning to China after previously fleeing in 2020, drawn back by a favorable business landscape. Alarmingly, around 25% of the manufacturing sites for key components are still based in China, according to an analysis of turbine platforms commonly used in Europe.

In response, Europe is mobilizing to bolster its own wind energy supply chains, aiming to minimize dependence on Chinese imports. Policymakers are hopeful that these measures will stimulate domestic manufacturing while keeping costs manageable. Andrea Scassola, Vice President of Supply Chain Research at Rystad Energy, emphasizes the urgency of this situation as Europe strives to regain its footing in the global renewable energy arena.