Unbelievable Surge: US Government Invests in Alaska Mining, Tripling Trilogy Metals Share Price!

Imagine waking up to find your investment has nearly tripled overnight! That’s exactly what happened to shareholders of Trilogy Metals this week as the US government made a stunning move that sent the company’s stock soaring.

On October 7, Trilogy Metals kicked off trading on the New York Stock Exchange at $7.23 per share, a jaw-dropping leap from the previous close of $2.09. By the end of the day, shares peaked at $7.98, marking an astonishing 280% increase—the company’s most significant single-day jump since April 2012.

But what sparked this meteoric rise? Late Monday, the White House announced a partnership with Trilogy Metals, clearing the way for the controversial Ambler Road Project in Alaska. This project aims to unlock domestic supplies of essential minerals like copper and other critical resources in an area that has been off-limits for some time. In a bold commitment, the government is investing $35.6 million to secure a 10% stake in Trilogy, with options to buy an additional 7.5%.

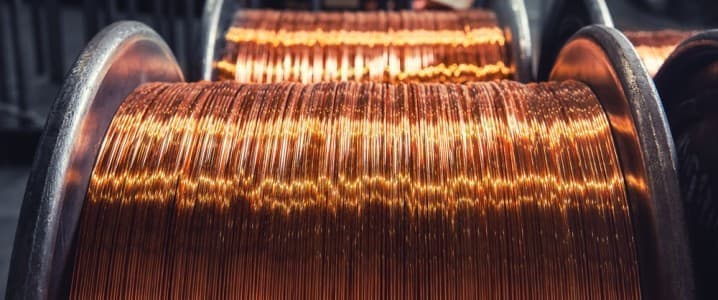

The Ambler Metals project is a collaboration between Australia’s South32 and Trilogy, focusing on precious deposits of copper, zinc, silver, and more. The road, which spans 211 miles, will provide vital access to these resources, aligning with the government's push to boost domestic mineral production and reduce reliance on imports, particularly from China.

Last year, the Biden administration rejected the road proposal due to environmental concerns and potential impacts on indigenous communities. However, President Trump has now reversed that decision, arguing that there is no economically viable alternative route.

This investment mirrors previous efforts, such as the US acquiring a 15% stake in rare-earth producer MP Materials and the Energy Department’s interest in lithium miner Lithium Americas. These strategic moves aim to fortify America’s mineral resources and reduce dependence on foreign imports.

Trilogy, despite being a small-cap mining company, is at the forefront of this pivotal moment in the mineral exploration industry, and the implications of this investment are monumental.