A CEO's Viral Moment Sparks a $7.7 Million Market Frenzy – Here’s Why It Matters!

What happens when a CEO’s personal life collides spectacularly with the financial world? Just ask Andy Byron, the executive who resigned in a whirlwind of public scrutiny and real-time trading chaos.

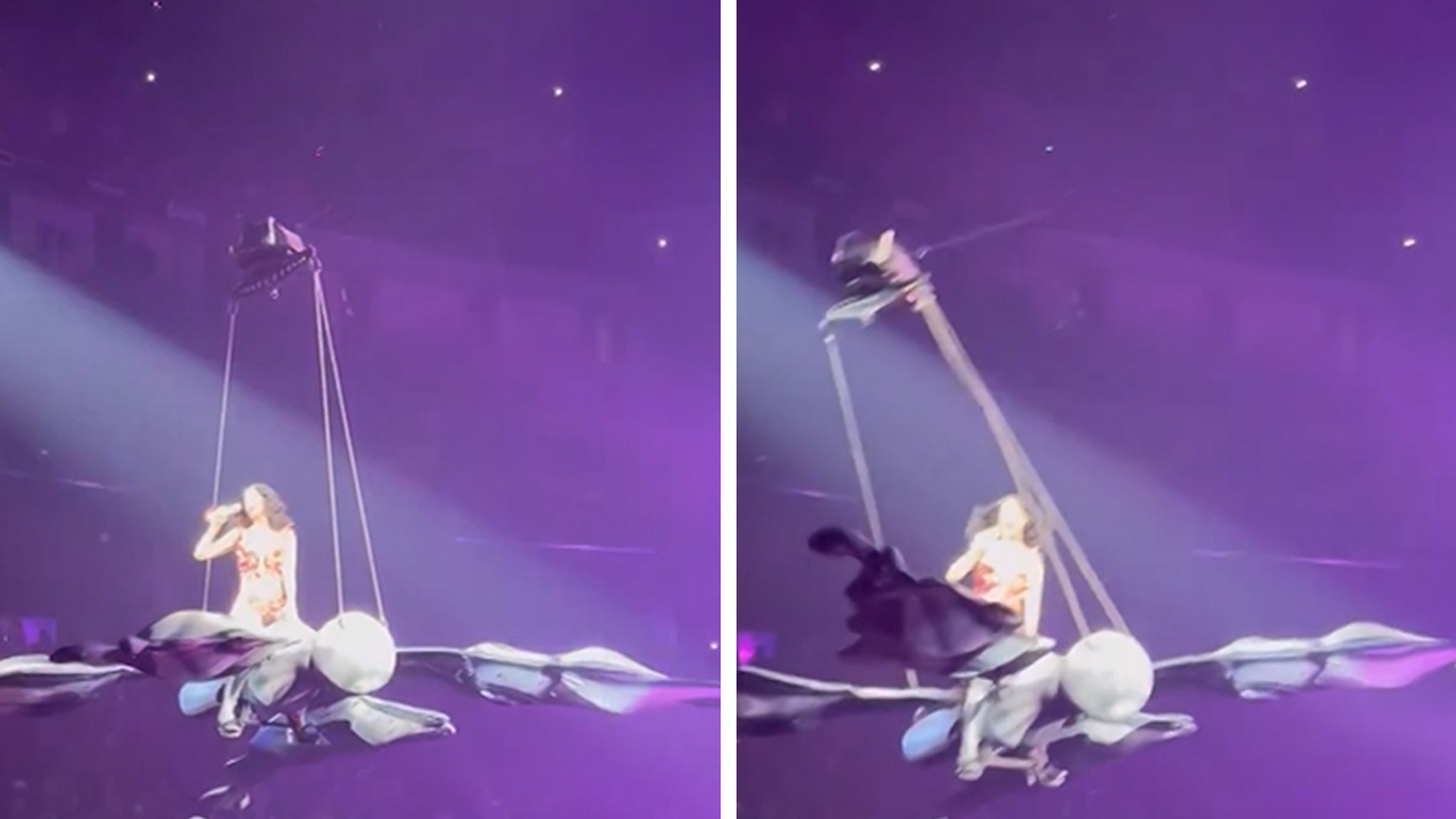

On a seemingly normal Saturday, Byron, the chief executive of Astronomer, stepped down after a rollercoaster few days marked by a viral ‘kiss cam’ moment at a Coldplay concert. That spontaneous moment of affection with HR head Kristin Cabot didn’t just raise eyebrows; it sent shockwaves through the trading platforms Kalshi and Polymarket, igniting a frenzy of speculation about Byron’s job security.

The kiss cam display, shared and savaged online, led traders to put the odds of his resignation at a staggering 65% on Kalshi and a wild 80% on Polymarket. This was no mere gossip; it had turned into a multi-million dollar bet, with traders pouring $2.4 million into Kalshi and an eye-popping $5.3 million into Polymarket. This incident became one of the most traded cultural flashpoints in prediction market history, trailing only behind high-stakes geopolitical events and elections.

But what exactly are prediction markets, and why are they gaining traction? Once seen as quirky offshoots of the financial world, these markets are now mainstream tools used to gauge public sentiment and corporate stability. As we inch closer to the 2024 U.S. presidential election, platforms like Kalshi and Polymarket are not just playgrounds for political enthusiasts anymore; they are being utilized by hedge funds, analysts, and policymakers to predict trends and reactions.

This incident at Astronomer reveals a startling truth: these markets are not just about forecasting—they are charged with creating conditions for action. The board at Astronomer acted swiftly, launching an investigation just days after the concert, placing Byron on administrative leave, and announcing his resignation less than 24 hours later. It raises a critical question: are corporate governance decisions now being driven by the gambling instincts of traders?

As Byron’s case illustrates, the implications for executives are profound. CEO behavior is now under constant surveillance, where personal conduct can translate into speculative volatility impacting company stock and reputation. A misstep could send financial ripples through an organization that were once confined to PR crises.

Moreover, the demand for transparency is escalating, pushing companies towards quicker public responses to crises. The expectation that executives disclose their missteps rapidly—especially under the watchful eye of prediction markets—has altered the traditional dynamics of corporate governance.

A striking example of this trend is the ongoing prediction market surrounding Federal Reserve Chair Jerome Powell, where traders are speculating on his potential ouster over his handling of interest rates. This suggests that these markets are becoming barometers of institutional credibility, interpreting and even performing market sentiment.

In the end, the story of Astronomer isn’t just a sensational headline; it’s a wake-up call to corporate America. In today’s world, where a fleeting personal moment can trigger an avalanche of market activity, executives must navigate a new landscape that intertwines public perception with financial stakes. The next viral moment might not be a kiss, but a tweet, a scandal, or even a candid photo, and it could just reshape the corporate world as we know it.