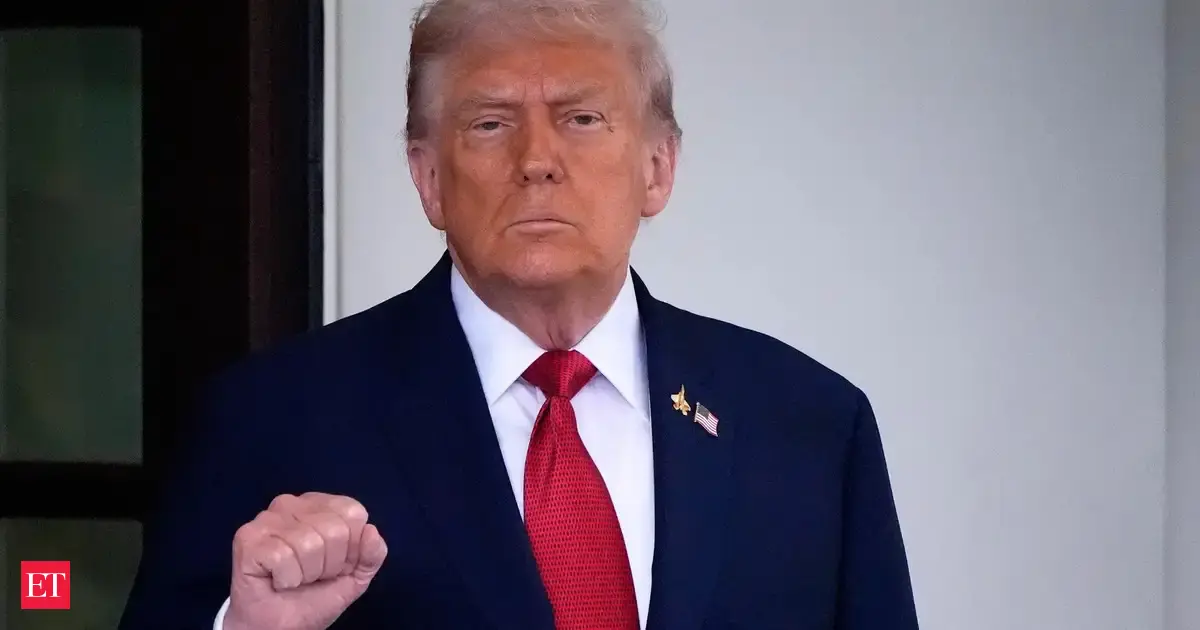

Trump's Shocking 100% Tariff on Pharmaceuticals: What It Means for India’s Drug Industry

Imagine waking up to find that the cost of your medication could double overnight—this is the reality facing many due to President Trump's new tariff announcement. A staggering 100% duty will be slapped on pharmaceutical drugs starting October 1 unless companies open manufacturing plants in the U.S. This unexpected move has sent shockwaves through Indian pharmaceutical stocks, leading to significant drops across the board.

On Friday, September 26, stocks took a hit with Aurobindo Pharma down 2.4% to Rs 1,070, Dr. Reddy’s tumbling 2.3% to Rs 1,245.30, and both Lupin and Cipla falling 2% each, closing at Rs 1,923.30 and Rs 1,480, respectively. Torrent Pharma fared the best, only sliding 1.5% to Rs 3,480.65. Analysts have raised concerns over how this will affect Indian drug manufacturers, who are vital players in the global pharmaceutical market.

Trump's decision comes amid a broader strategy to bolster American manufacturing, stating that foreign companies flooding the U.S. market necessitates a protective stance for national security reasons. Besides pharmaceuticals, the new tariffs also target kitchen cabinets, furniture, and heavy trucks, reflecting the administration's aggressive policy approach.

In 2024, the U.S. imported nearly $233 billion worth of pharmaceutical products, with Indian companies supplying a significant portion of the U.S. healthcare system—accounting for four out of every ten prescriptions filled. The economic implications are enormous; reports indicate that Indian medicines saved the U.S. healthcare system a staggering $219 billion in 2022 alone. With the prospect of prices skyrocketing, this new tariff could threaten not just the affordability of medications but also the overall economic stability as inflation concerns rise.

To mitigate the fallout from these tariffs, the Indian government is reportedly seeking to boost drug exports to markets in Africa, Latin America, and Southeast Asia, aiming to reduce dependence on the U.S. market. The Pharmaceuticals Export Promotion Council of India (Pharmexcil) is also exploring opportunities to expand sales in China to address the growing trade deficit. This proactive approach highlights the resilience of India's pharmaceutical industry in the face of increasing challenges.

As we approach the October deadline, the question looms: will India’s pharmaceutical sector adapt swiftly enough to shield itself from these tariffs, or will this lead to a healthcare crisis for millions of Americans? The world watches with bated breath as these developments unfold.