Hawaii to Implement New Hotel Tax to Address Climate Change Challenges

HONOLULU In a groundbreaking move, lawmakers in Hawaii are set to increase the hotel tax imposed on travelers staying at hotels, vacation rentals, and other short-term accommodations. The additional revenue generated from this tax hike will be specifically allocated to programs aimed at combating the effects of climate change.

State officials have outlined several key projects that will benefit from the expected influx of funds, including the replenishment of sand on eroding beaches, assisting homeowners in installing hurricane clips on their roofs, and removing invasive plant species that have contributed to environmental catastrophes, such as the devastating wildfire that swept through Lahaina two years ago.

A bill that is scheduled for votes in both the House and Senate on Wednesday proposes an increase of 0.75% to the existing daily room rate tax, which will take effect starting January 1. Given that the Democratic Party holds supermajorities in both chambers and has shown strong support for this measure, its passage is virtually assured. Governor Josh Green has expressed his intention to sign the bill into law, reinforcing the commitment to climate resilience.

Officials project that this tax increase will yield approximately $100 million in new revenue each year. Governor Green emphasized the importance of these funds in preventing future tragedies, referencing the $13 billion economic loss and the tragic loss of 102 lives in the Maui wildfires. These kind of dollars will help us prevent that next disaster, he stated during an interview.

Green also highlighted that Hawaii is pioneering this initiative as the first state in the nation to earmark lodging tax revenue specifically for environmental protection and climate change mitigation. According to Andrey Yushkov, a senior policy analyst at the Tax Foundation, there are currently no other states known to be following a similar approach.

The new tax increase will add to an already substantial tax burden on short-term accommodations. The current daily room rate tax of 10.25% will increase to 11%. Additionally, Hawaii's counties impose their own 3% surcharge, while both the state and counties together apply a combined general excise tax of 4.712% on goods and services, including hotel stays. Consequently, the overall tax rate on hotel rooms will approach 19%, making it one of the highest in the United States.

According to a 2024 report by HVS, a global hospitality consulting firm, the only large U.S. cities with higher cumulative state and local lodging tax rates are Omaha, Nebraska, at 20.5%, and Cincinnati, Ohio, at 19.3%.

Governor Green has long advocated for the idea that the 10 million visitors who come to Hawaii each year should also contribute to the protection and preservation of the state's environment for its 1.4 million residents. He is optimistic that travelers will embrace the tax increase, recognizing it as a means to maintain Hawaii's pristine beaches and cherished landmarks, such as the scenic Road to Hana in Maui and the iconic North Shore of Oahu. Following the Maui wildfires, Green reported receiving numerous inquiries from concerned individuals across the nation looking for ways to help, suggesting that this tax could provide a significant opportunity for contribution.

The hotel industry, however, has mixed feelings about the new tax. Jerry Gibson, the president of the Hawaii Hotel Alliance, which represents local hotel operators, expressed relief that the proposed tax increase was not larger than the initial proposals. I don't think that there's anybody in the tourism industry that says, 'Well, let's go out and tax more.' No one wants to see that, Gibson stated. However, he acknowledged the necessity of funding to support Hawaii's environmental needs and noted that if the tax revenue indeed helps beautify the islands, then it could be worthwhile.

Hawaii has faced ongoing challenges in financing the extensive environmental and conservation needs of the islands, which range from protecting delicate coral reefs to managing invasive plant species and ensuring that tourists do not disturb wildlife, such as the endangered Hawaiian monk seals. The state's extensive network of trails is also in need of maintenance, particularly as more travelers choose to hike during their vacations.

Two years ago, Hawaii lawmakers proposed a plan that would have required tourists to purchase a yearlong license or pass to access state parks and trails. Governor Green had suggested a $50 entry fee for all visitors, but this idea was met with resistance due to concerns over potential violations of U.S. constitutional protections on free travel. The current lodging tax increase is seen as a more palatable compromise, especially in light of the urgency brought on by the devastating wildfires in Maui.

Despite the anticipated revenue, advocacy group Care for Aina Now has identified a staggering $561 million gap between Hawaii's conservation funding needs and the current budget allocation for such efforts. Governor Green has acknowledged that the revenue generated from the tax increase will not fully close this gap; however, he has indicated that the state would issue bonds to amplify the funding raised through the new tax. The majority of the anticipated $100 million will be directed towards projects that can be completed within a one-to-two-year timeframe, while an estimated $10 to $15 million will support long-term infrastructure development.

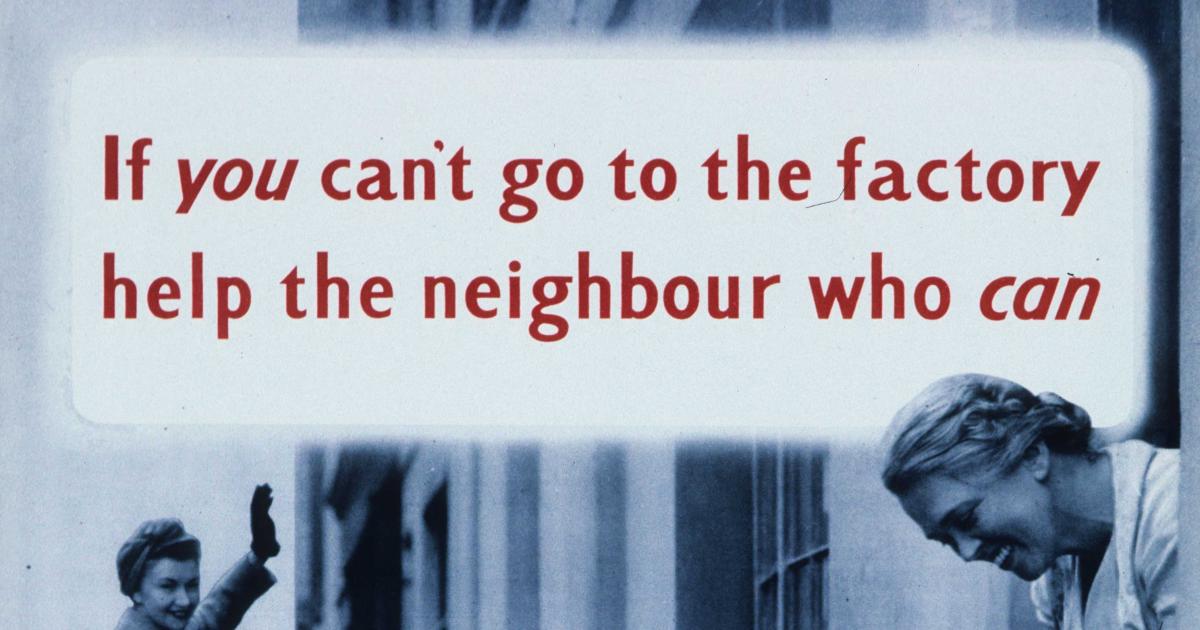

Kwika Riley, a member of the governor's Climate Advisory Team, summarized the philosophy behind the new tax with a traditional Hawaiian saying, A stranger only for a day, which underscores the idea that visitors should contribute positively to the places they visit. Nobody is saying that literally our visitors have to come here and start working for us. But what we are saying is that it's important to be part of the solution, Riley conveyed. It's important to be part of caring for the things you love.